Special Situations & Turnaround Advisory

Our special situations solutions are tailored for unique conditions arising from liquidity challenges, debt maturities or covenant compliance issues. Whether the goal is reorganization, recapitalization or growth, BizCap® professionals have the skill, knowledge and market insight to quickly and efficiently deliver a capital solution tailored to your specific situation.

In these situations, it is often imperative that the company and its advisors respond quickly to maximize the range of solutions available and, ultimately, preserve value for the company’s stakeholders. BizCap® has extensive experience with proceedings and consummating transactions both in and out of court.

- Turnaround, Interim & Crisis Management

- Transformation & Operational Improvement

- Corporate Turnaround & Restructuring

- Organizational & Financial Restructuring

- Business Debt Restructuring

- Enterprise, Profit & Working Capital Improvement

- Asset Rationalization

- Labor Efficiency

- Debt Capital Solutions

- Distressed Sale Advisory

- Lender / Creditor Negotiation

- Out-of-Court Workouts

- Bankruptcy (Pre & Post) Advisory

- Decreases risk of delinquent debt

- Provides a platform for growth

- Provides substantial flexibility

- Restores supplier & customer confidence

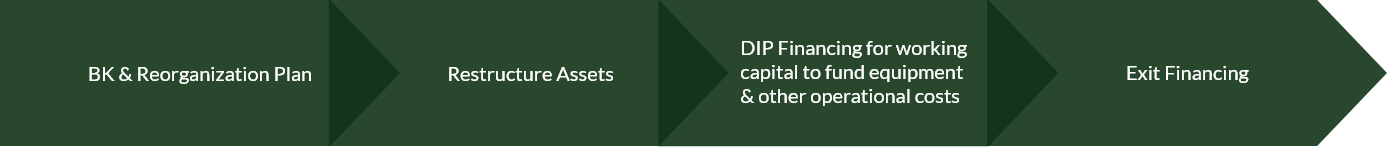

Exit Financing can facilitate a plan of reorganization and even be packaged with DIP financing as part of a total recapitalization strategy.

- When speed, smarts and execution count, BizCap® delivers.

- BizCap® has deep experience in both healthy and distressed sell-side situations, and the ability to switch our team and proprietary process into highly specialized mode for this type of transaction.

- Our firm is full of experts when it comes to negotiating with debt and critical vendors.

- Satisfy creditors based on what your business can afford

- Reduce debt and stretch it out over time into fixed, affordable monthly payments

- Spend less time dealing with creditors, collection agencies and attorneys

- Spend more time creating revenue and optimizing your business

- Keep your doors open and retain management control

- Avoid unnecessary legal fees and/or bankruptcy

- Balance your budget and manage cash flow

- Preserve vendor relations and keep vital supply lines open

- Rebuild your credit and credibility

- BizCap®’s Assignment for the Benefit of Creditors (ABC) service is a powerful tool that can create an effective alternative for companies considering filing bankruptcy

- BizCap® will leverage our deep relationships with potential buyers in the marketplace and implement our proven ABC process to bring additional value to an assets

- Our Bridge Financing solutions will get your business to the profitability zone when traditional financing is not an option.

- We can provide the quick source of working capital to take advantage of opportunity or meet obligation.

- We can customize a longer-term financing solution when your business is ready.

- Perform detailed, up-front due diligence, develop a full understanding to position the business positively in the marketplace and minimize the likelihood of negative surprises in lender due diligence

- Reorganize & restructure financial assets and liabilities to create the most beneficial financial environment for the company

- Advise on the optimum corporate financing structure

- Selectively determine most targeted group of investors and capital providers

- Prepare requisite offering materials

- Market the business strategically and confidentially

- Negotiate the best terms

Transactions

The Bizcap Difference

BizCap® is a phenomenal partner to have amid the turbulence that sometimes happens to a business. They were there for us when we had an unexpected downsizing and had to reconfigure our finances and financial plan. Their team stepped up and helped us right the ship and move us positively forward. Then, when the Covid-19 work rules impacted the entire economy and our business, BizCap® jumped in to help us find a lender as our bank was not a participant in the SBA lending program. Almost overnight, BizCap® made the difference after weeks of stress. BizCap® has always been there, prompt and solid to their word.

The entire team at BizCap® was an excellent partner of Naumes, Inc., providing us with several financing options and helping us navigate a complex financing transaction. BizCap®’s rigor, discipline and experience enabled us to secure a new lending relationship, with a valuable partner. It was a pleasure working with the BizCap® team and we are very appreciative of their efforts and expert advice.

I referred my client, a public healthcare district that filed bankruptcy and closed its hospital, to BizCap® for financing. Despite the troubled financial condition of the hospital, BizCap® generated multiple options for the client to allow them to reopen. Throughout the process, the entire BizCap® team was hands-on, innovative and wholly engaged in our mission and success.

BizCap® assisted one of our clients who had filed for bankruptcy and was in need of debtor in possession financing. They performed beyond our expectations. Their staff was professional, grasped the situation quickly and underwrote to our clients current situation and future projected financial performance. As a result, they were able to secure previously elusive capital providing our firm the ability to deliver on our clients requests in a matter of weeks. We were totally impressed with their dedication and performance. BizCap has our highest recommendation.

A big thank-you to the BizCap® Team, a true partner! Their expertise is clear and, what I have appreciated the most, is their willingness to mentor and guide us through the process from beginning to end. Due to the complexity and tight deadlines of the deal, we definitely would not have been able to close the deal without BizCap®. This team was stellar, supporting key elements of the deal on our behalf when my plate was full.

I recently met with a client who had lost all hope. This client’s incumbent bank did not want to renew their existing line of credit and the debt service was severely affecting liquidity, the client thought their only alternative was to file bankruptcy. I recommended that they talk to the BizCap® team before we moved ahead with the filing . The BizCap® team was able to recommend a different loan structure, identify and monetize under-reported assets to secure Sr. as well as Jr. capital take out financing for the client.

Recently, I had the pleasure of working with the BizCap® team on a distressed refinancing. The borrower had been financed by a notoriously difficult hedge fund lender that was looking to exit the market after the loan matured. It seemed like an impossible situation until BizCap® got involved. They quickly established credibility with the lender, canvassed the market, and put together a financing package that the client was very pleased with.

BizCap® was able to deliver a financing solution flexible enough to provide an 8-figure credit facility to take out our client’s commercial bank loan and still provide the liquidity that the borrower needed. We were impressed with BizCap®’s immediate grasp of the borrower’s needs, their understanding of the type of financing which would be productive for the borrower, and their ability to effectively manage the due diligence and closing of a complex transaction.

The team at BizCap® are highly trained, professional deal makers who have assisted us in a number of successful, out-of-court debt restructuring and recapitalization projects. BizCap® is remarkably efficient and effective in dealing amicably and objectively with a large numbers of creditors. Their assistance in implementing out-of-court debt restructuring plans and financings has resulted in significant reduction in costs and delay, allowing clients that could not have afforded the administrative costs of a Chapter 11 to restructure and continue to operate.

It is my pleasure to recommend BizCap® to assist companies that are either in distress or have unique financing requirements. Without the assistance of BizCap® our company, Gruber Systems, would have not survived the economic disaster caused by the 2008 financial crisis. Banks were nowhere and most non-traditional sources were beyond our financial ability and size to execute. So, Thanks to BizCap for helping our company get through those difficult times.

BizCap® came through for Pacific Steel when we were at a critical juncture; they augmented my staff by aggregating and managing a significant number of funding sources. We benefited greatly from their capability to underwrite our credit through the eyes of a credit committee, which resulted in a fluid refinancing process for Pacific Steel.

The outstanding team at BizCap® provides top notch service and expertise to clients seeking financing in challenging, hyper growth, distressed or other unconventional circumstances. They approach difficult credits with a high level of sophistication and adaptability, their brand of lending services is much needed in the marketplace. We have had the pleasure of working with BizCap® on several deals and witnessed their ability to finance transactions in a variety of situations when procuring funding has seemed unlikely or remote.

We have worked with the BizCap® team for years and I’ve always been very impressed with their intense focus on helping clients in the most challenging situations – they go above and beyond to do what seemingly can’t be done. Their innovative thinking and intelligence combined with urgency and action, result in a fast, optimal outcome for all parties. I just used BizCap® on a $20MM refinance of a Central Valley grower and land developer – and his team pulled off what can only be described as a "miracle".